VAT Penalties Guide

Sep. 13, 2023, 10:05amVAT Penalties Reminder

Penalties for submitting VAT returns or paying VAT late, came into effect on 1 January 2023. The HM Revenue & Customs (HMRC) VAT penalties replace the default surcharge.

Who do the VAT Penalties affect?

The changes affect everyone submitting VAT returns for accounting periods commencing on or after 1 January 2023. Any nil or repayment VAT returns received late will also be subject to late submission penalty points and financial penalties.

What will happen if you submit a VAT return late?

Late submission penalties work on a points-based system. One penalty point applies for each VAT return submitted late.

Once a penalty threshold is reached, however, a £200 penalty applies. Plus, a further £200 penalty for each subsequent late submission will then apply.

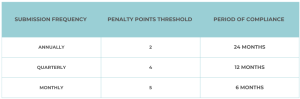

The penalty points threshold varies according to the submission frequency of the return. Take a look at our handy table below:

It is worth noting, that it is possible to reset the points back to zero. This is if subsequent returns for the period of compliance are submitted on or before the relevant dates.

What will happen if you do not pay your VAT on time?

In summary, the rate of penalty depends on how late the payment is:

- Up to 15 days overdue – there is no penalty. This is providing that the outstanding VAT is paid in full or a payment plan is agreed with HMRC before day 16.

- Between 16 and 30 days overdue – there will be a penalty of 2% on the VAT owed at day 15 if this is paid in full or a payment plan is agreed with HMRC between days 16 and 30.

- 31 days overdue – there will be a penalty of 2% on the VAT owed at day 15 plus 2% on the VAT owed at day 30 if the VAT is paid in full or a payment plan is agreed with HMRC on or after day 31.

- More than 31 days overdue – there will be a penalty calculated at 2% on the VAT owed at day 15 plus 2% on the VAT owed at day 30.

- There will then be a second penalty calculated at a daily rate of 4% per year for the duration of the outstanding balance. This is calculated when the outstanding balance is paid in full or a payment plan is agreed.

To give businesses time to get used to the changes, HMRC will not be charging a first late payment penalty for the first year from 1 January 2023 until 31 December 2023, if the VAT is paid in full within 30 days of the payment due date.

How will late payment interest be charged?

From 1 January 2023, HMRC will charge late payment interest from the day the payment is overdue to the day the payment is made in full. Late payment interest is calculated at the Bank of England base rate plus 2.5%.

Introduction of repayment interest

The repayment supplement was withdrawn from 1 January 2023. For accounting periods starting on or after 1 January 2023, HMRC pay repayment interest on any VAT owed. This will be calculated from the day after the due date or the date of submission (whichever is later) and until the day HMRC pays the repayment VAT amount due in full. Repayment interest will be calculated at the Bank of England base rate minus 1%. The minimum rate of repayment interest will always be 0.5%.